Penthouse with a sea view in Benidorm

First sea line!

Profitability of 50%!

First place on the real estate market!

A rare chance to invest and earn money quickly!

Do not miss the opportunity!

An amazing offer - a new project on the FIRST SEALINE! Only 2 minutes from the beach! Luxury residential complex! One of the most interesting new developments! The pearl of the Costa Blanca!

Why is this residential complex unique?

In Spain the number of coastal land for construction is very limited. Especially, on the first line of the sand and pebble beach, especially in the eucalyptus grove, especially in close proximity to the most popular resort of Spain - the city of Benidorm, where the brightest entertainments, the best in Europe sunny beaches, great clubs, different restaurants, water parks, zoos, amusement parks, magnificent excursions and boat trips are.

What are the advantages of this residential complex?

There are lots of undeniable advantages! First, a favourable location: on the first line of the most beautiful bay, inside the green protected area and at the same time just 3 minutes from the large tourist city of Benidorm. No multi-storey buildings built nearby in the future.

- Golf fields – 10-minutes drive.

- Downtown of Villajoyosa with its restaurants and cafes - 4-minutes drive.

- Supermarkets, shopping and entertainment centre La Marina, La Cala district - 5-minutes drive.

- Within walking distance there are 2 grocery stores, restaurants, cafes and bus stops.

- Alicante airport is 35 minutes by car.

- The amusement parks Terra Mítica and Iberia Park, Terra Natura zoo and water park Aqua Natura, karting and other entertainment and shopping places are only 5-10 minutes by car or 10-15 minutes by bus.

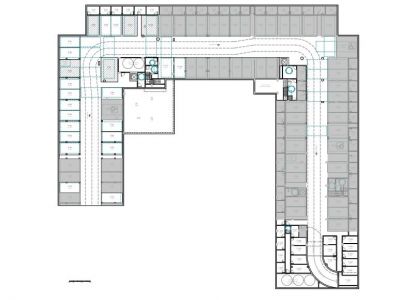

Second, modern architecture! Low-rise buildings, materials of the best brands and manufacturers, first-class interior decoration, complete central air-conditioning system, equipped kitchen, powerful hood, high-quality ceramic tiles, double glazing, entrance doors with improved security system, underground garage and storages.

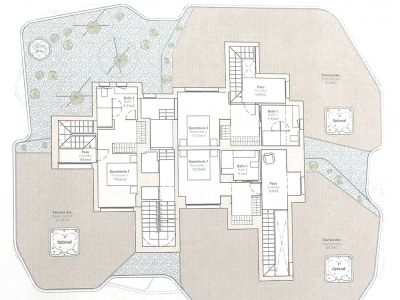

Come and live! Only for property owners - heated pool and summer pool, SPA, gym, sun beds and umbrellas, beautiful green park areas, playgrounds for children. It is possible to place a Jacuzzi on the upper terrace of the penthouses, from where magnificent panoramic views open! Inside territory is equipped with video security system.

A delightful view of the Mediterranean Sea from the terraces and balconies!

Is it a safe investment?

The safety of investments is guaranteed by the Spanish bank. The buyer pays reservation amount, thus securing the property for himself. The remaining amount is paid according to the agreed terms, and each payment is secured by a bank guarantee. That is, in simple words, the funds are kept in a special account and the developer has no right to use it until the fulfilment of his obligations established in the signed sales contract. In case of default by the developer, bank returns all paid funds to the buyer.

No financial loss!

Who can buy?

This is the best offer for those who want to buy property in a prestigious residential complex on the first beach line on the sunny coast of Costa Blanca. It is an excellent choice for private life and making profit! Don’t miss the chance to become an owner of luxury real estate! We recommend this residential complex as a profitable acquisition and successful investment!

How much is it?

Prices from the developer! Starting prices! The prices for new ultra modern seafront apartments and townhouses are lower than in other popular Spanish resort cities!

At the moment the prices for the first beach line real estate are very low! Since the beginning of construction prices have already increased 2 times and are expected to rise more!

Apartments:

1 bed / 1 bath from 162.000 €

2 bed / 2 bath from 197.000 €

3 bed / 2 bath from 289.000 €

Duplexes 2 bed / 2 bath from 315.000 €

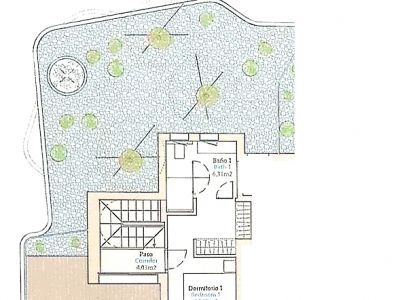

Penthouses 3 bed / 2 bath from 400.000 €

Townhouses with private plot, terrace and BBQ:

2 bed / 2 bath from 235.000 €

3 bed / 2 bath from 356.000 €

Price for 1 sq. m. varies from 2.100 – 2.600 €, depending on the sea view and location inside the building.

How much it is possible to earn?

It is the most profitable investment project that only in the first 12 months will bring profit up to 50% of the invested capital (even before the end of construction!). Real high income without complex schemes and business processes! Profitable rental is guaranteed!

In other words, it will be possible to sell apartments for at least 50-70.000 € more and townhouses for at least 100.000 € more, and even more expensive in 2 years.

When is the best time to buy?

Now! Prices in the residential complex are going up! There is a high demand for properties of this type and a very limited number of offers on the real estate market. Prices are forecast to rise in the next 10 years! We advise you to hurry up, because our clients and we ourselves have already bought a number of units in this residential complex.

The I Phase of construction is almost sold out!

How to buy?

Very easy! You can apply for up to 60% mortgage. Non-residents need to pay 40% within a year (from 100.000 € and more, depending on the unit price) and the remaining 60% will be provided by the Spanish bank to the date of the deed signing at the notary. Non-residents are given 60% under 2,5 - 3,6% per annum for 20 - 25 years. Mortgage borrower should be no more than 75 years before the end of all payments.

Purchase costs

In case you buy new development home fees, taxes and other expenses are about 12,5-14%:

- 10% - VAT - is paid with each payment in a corresponding amount.

- 1,5% - new development tax if it is a second home and 0,1% if it is a habitual residence.

- 0,5 -1,5% - registration and notary fees when buying a property paid at registration of purchase and sale.

- 0,5% - lawyer assistance, arrangement of supply contracts and connections.

- other expenses such as property insurance, translations, issue of a check, etc.

Terms of payment:

Perfect terms of payment! For non-residents and non-fiscal residents:

- 6.000 - 12.000 euro - reserve - depending on the price of the object. (6.000 euros - up to 300.000 euros, 12.000 euros - more than 300.000 euros).

- 20% of the cost + 10% VAT (less the reservation amount) - within 2 weeks from the signing of the sales contract.

- 10% of the cost + 10% VAT – in six months after the signing of the sales contract.

- 10% of the cost + 10% VAT – in twelve months after the signing of the sales contract.

- 60% of the cost + 10% VAT – balance, during the signing of the deed at the notary - November-December 2020.

I Phase completion date is April - May 2020.

Buy for yourself or invest while there is an opportunity and get a high income!

Recently Spanish real estate sales statistics has grown steadily. There is an increased demand for new developments in the Costa Blanca region, where the resorts are open 365 days a year. It is here where two types of the lucrative business and highly profitable investments in Spain thrive:

- Buy-To-Let,

- Purchase of properties under construction in order to sell it after construction is finished with the price increased by 30-50%.

This type of investment provides you with a stable income at minimal risk!

Five-step action plan after making a decision:

Step 1. Signing of the reservation contract and payment of the reservation amount of 6.000 €/12.000 € - depending on the property price.

All transfers of funds to the developer are made by bank transfer only, non-cash. Therefore, the reservation amount may be transferred from any account of any country or paid in cash through the current account of our company. The buyer receives the reservation payment confirmation with the buyer’s details and the reservation contract signed by both parties. If the buyer refuses to purchase, the deposit is not refundable. If the developer refuses to sell, the deposit is returned in double amount.

Step 2. Signing of the sales contract and payment of 20% + VAT.

Sales contract preparation period - within 1-2 weeks from the reservation payment date and reservation contract signing. 20% of the cost + 10% VAT (less the previously paid reservation amount) are paid from the buyer’s Spanish bank account. If necessary, sales contract preparation period can be extended to up to 1-2 months.

Step 3. Payment of 10% + VAT.

Payment of 10% of the cost + 10% VAT is transferred from the buyer’s Spanish bank account in six months after signing the sales contract.

Step 4. Payment of 10% + VAT.

Payment of 10% of the cost + 10% VAT is transferred from the buyer’s Spanish bank account in twelve months after signing the sales contract.

Step 5. Signing of the “Escritura” (the deed) at the notary and payment of 60% + VAT.

It is possible to borrow up to 60% mortgage, which should be arranged 1-2 months prior to the signing of the deed at the notary. If needed, our company will provide you with a list of all necessary documents.

The remaining 60% + 10% VAT are to be paid at the signing of the deed at the notary in the form of a Spanish bank check, ordered and issued in advance. Payment of the remaining amount under the contract and the signing of the “escritura” at the notary is the confirmation of the transfer of ownership, and the buyer becomes an owner. After signing the “escritura”, the notary informs Property Register about the completed transaction, which, in turn, registers the new owner and in 2-3 days it is already possible to receive the corresponding official document “Nota Simple” with the information about the new property owner.

Lawyer Assistance

For complete control over the purchase procedure from the very beginning to the final registration at the Property Register, we recommend Spanish lawyer assistance. We have already made a number of deals at this residential complex, so our lawyer has already studied and checked all the developer’s documents. Nevertheless, the construction is not completed yet, and the signing of the deed at the notary is ahead, therefore assistance of experienced Spanish lawyer is highly recommended. He is a responsible person for each stage of the transaction and he is the one who checks the bank guarantee for each payment.

As a general rule, lawyer's fee is 1% of the cost, but for our clients who purchase property in this residential complex, there is a very good offer – only 0,5% of the cost. Our lawyer checks all the documentation and in addition arranges water and electricity supply contracts, contract with community (“comunidad”), real estate tax registration, re-registration of real estate tax and garbage tax, tax registration of foreigner’s NIE identification number, etc., as well as verification of the bank guarantee issued by the developer for each payment under the sales contract. It is extremely important to check the correctness of the issued bank guarantee, because before the transfer of ownership it is one of the most important documents that guarantees the return of funds in case of default by the developer.

The buyer himself should deal with all of the above issues or hire someone, but it costs more than 0,5% of the price, so we agreed to include all these issues in lawyer assistance.

Cost reduction for our customers

1. Buyers don’t have to pay us; we get a commission from the developer. The developer of this residential complex doesn’t provide any discounts to anyone.

2. Our company provides real estate service to the developer and acts as a translator during the entire purchase procedure, as well as during the signing of the “escritura” at the notary.

3. Spanish banks only accept certified translations of all foreign language documents done by Spanish legal interpreters. The cost is 50 € per page. There is a very good offer for our clients purchasing property in this residential complex – only 30 € per page.

4. Bank commission for issuing a check is 0,4% of the amount. There is a very good offer for our clients purchasing property in this residential complex – 40% discount on condition that real estate insurance is done in the insurance company of our partner - Sabadell Bank, plus additional bonuses.

Thus, we minimize the costs of our customers on translations and interpreters, on bank commission and other services that accompany the purchase of real estate in Spain.

Until the end of the year we carry out promotional campaign with bonuses and discounts:

In case you buy a property that costs more than 250.000 € with the help of our company, you may choose one bonus:

- We want you to enjoy travelling around Spain and we give you a car (gift certificate 3.000 €);

- We want you to have a comfortable new home in Spain and we give you a furniture set (gift certificate 2.500 €);

- We want you to save money and we give you a discount on the purchase of a real estate in Spain (gift certificate 2.000 €).

In case you buy one of our properties that costs more than 500.000 € without a loan, our lawyer will take care of all the procedures of issuing a Spanish Golden Visa for you! It means that if you buy a property with us, you get Spanish residence permit at our expense. Usually the cost of lawyer assistance in issuing Spanish Golden Visa starts from 5.000 €. Our company saves your money and minimizes your costs!

You have a choice - to obtain an Investor Visa or to use this amount in any way such as to buy furniture, a car, or you can use it to pay for the lawyer assistance! The choice is yours!

Necessary documents for opening a Spanish bank account:

1) Pre-contract (reservation contract, letter of intent) for the purchase of a real estate.

2) Full name of the future bank account owner, address of residence, a valid postal address (in Latin letters), profession, job position, tax identification number and international passport (copy of all pages).

As a rule personal presence is required at the opening of a bank account. But, if needed, we can open an account without your presence (thanks to a long-time and successful work with the bank!). In this case, it is necessary to sign all banking documents and send it at our email. The original documents you will sign upon arrival in Spain.

3) A cash flow statement of your current account for the last 6 months. If the statement is done in English or Spanish, then the translation is not needed. If the statement is done in any other language, please, send it at our email and we will arrange the certified translation.

4) Income document(s) or employment certificate for the last 12 months. If the documents are done in English or Spanish, then the translation is not needed. If the documents are done in any other language, please, send it at our email and we will arrange the certified translation.

We order certified translations for all foreign language documents at the Spanish legal interpreters registered in Spain!

If desired, you may order certified translations for all foreign language documents into Spanish at the Spanish Embassy or Spanish Consulate in the country of your citizenship or residence.

NOTE!

It takes about 2-3 days to check all translated documents and to make the new bank account operative. To activate your new account it is necessary to make a transfer of any amount from the bank of the country of your citizenship or residence.

As a rule Spanish bank asks to confirm the origin of funds for the purchase. Any document from the last 10 years will do: income and salary documents, the sale of real estate or vehicle, loan agreements, dividends and royalties, etc., that show the origin of the money.

Profitable income from luxury rental and property resale!

Our company is a buyer of several units as well. Our aim is to open an office of elite rentals, property management and resale at a higher price than during the construction period. These types of service we will provide for our customers who bought property with the help of our company.

Due to the shortage of offers, there is a high demand for luxury real estate, both for holiday, and for renting, which is a very profitable business for us and our investors. Sales in this residential complex go on tremendously fast and prices have already risen twice since the beginning of construction.

Next phase apartments and townhouses are already on sale, and our company has already sold several units from that phase.

We accompany our clients through the entire process up to the final registration at the Property Register; we constantly send buyers videos and photos of the construction progress!

If you have any questions, please, contact us and we will give you all the details!

And once again we remind you of the unique features of the complex:

FIRST SEA LINE!

PROFITABILITY MORE THAN 50%!

FIRST PLACE ON THE REAL ESTATE MARKET!

A RARE CHANCE TO INVEST AND EARN MONEY QUICKLY!

DO NOT MISS THE OPPORTUNITY!